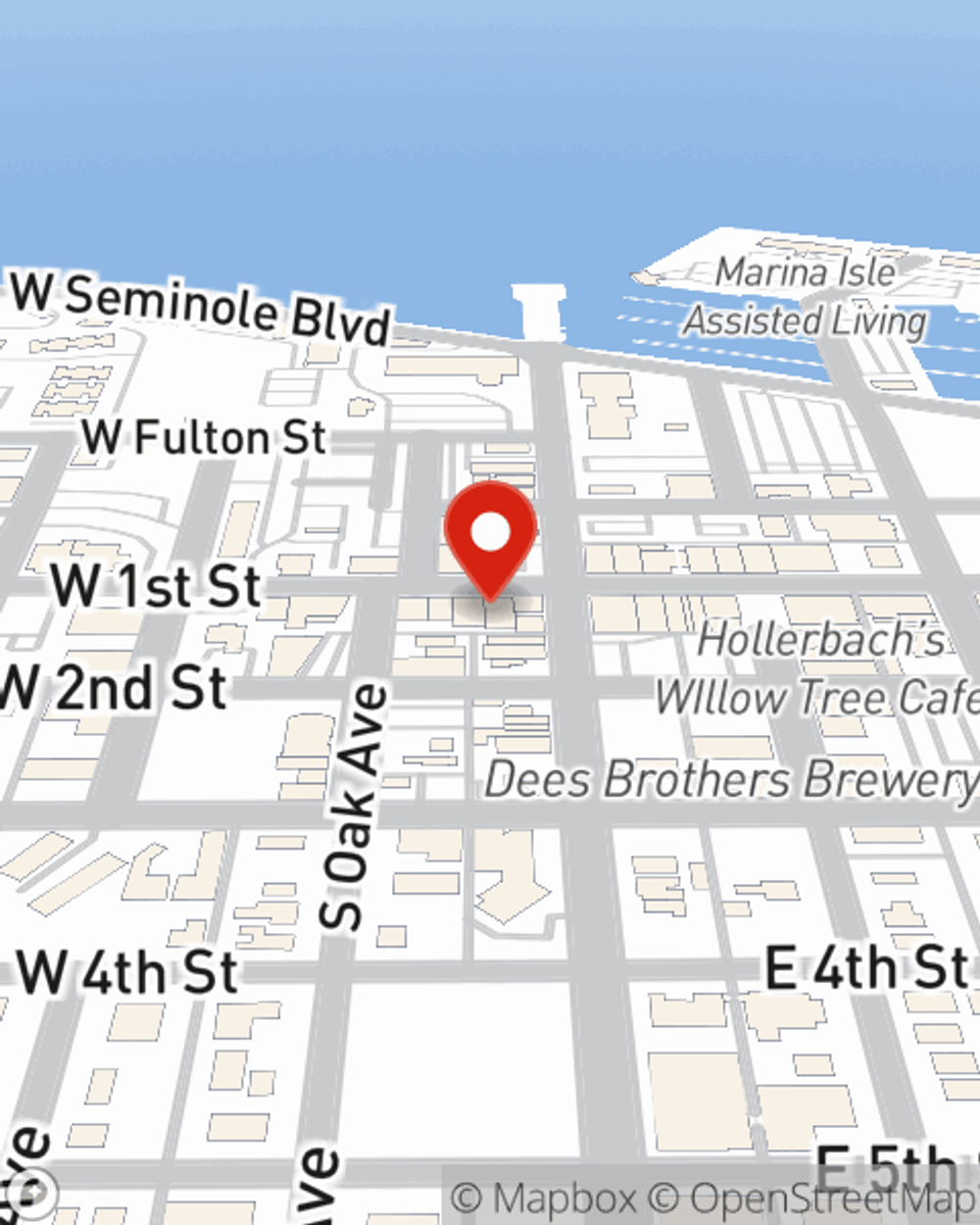

Business Insurance in and around Sanford

One of Sanford’s top choices for small business insurance.

This small business insurance is not risky

- Sanford

- Altamonte Springs

- Casselberry

- Lake Mary

- Longwood

- Mount Dora

- TAVARES

- Winter Springs

- Clermont

- DAYTONA BEACH

- Eustis

- ORMOND BEACH

- DELAND

- PORT ORANGE

- ORANGE CITY

- DELTONA

- DEBARY

Help Prepare Your Business For The Unexpected.

Operating your small business takes creativity, dedication, and excellent insurance. That's why State Farm offers coverage options like worker's compensation for your employees, a surety or fidelity bond, business continuity plans, and more!

One of Sanford’s top choices for small business insurance.

This small business insurance is not risky

Protect Your Future With State Farm

Why choose State Farm for coverage? Your fellow business owners have rated State Farm as one of the top overall choices for insurance coverage by small business owners like you. You can work with State Farm agent Alexia Emerson for a policy that safeguards your business. Your coverage can include everything from worker's compensation for your employees or extra liability coverage to mobile property insurance or professional liability insurance.

Call Alexia Emerson today, and let's get down to business.

Simple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".

Alexia Emerson

State Farm® Insurance AgentSimple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".